The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) has increased its Australian…

The Chinese appetite for Australian barley since the removal of tariff measures over one year ago continues unabated, as detailed in last month’s edition. With this comes the perennial discussion about how much of this barley goes into the malting process and how much is sold as feed. Here we have a shot at estimating this year’s breakdown.

The Australian Harmonized Export Commodity Classification (AHECC) has three categories for barley: one for seed, one for malting excluding seed and one for feed excluding seed and malting. The issue with these metrics is that parcels of FAQ or Multivarietal Malting grade are sometimes classified as Malt and sometimes classified as Feed which corrupts official figures. Given this, we have to take a different approach to make an estimate of the Malting, FAQ and Feed barley that is expected to be shipped to China this marketing year, Oct23-Sept24.

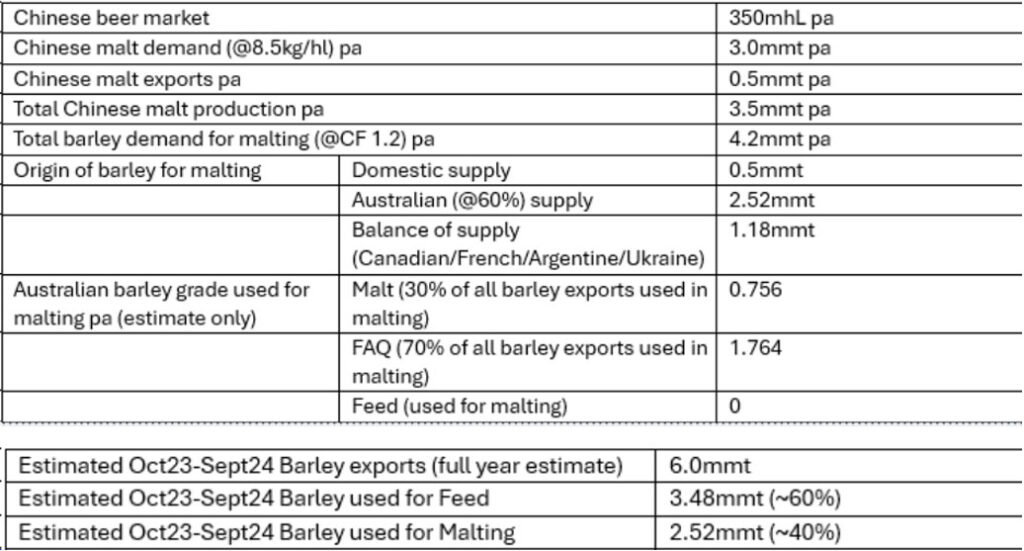

Chinese brewers are expected to brew 350mhL this current marketing year and with exports, Chinese maltsters are expected to call for 4.2mmt of barley to supply 3.5mmt of malt. Since the tariffs on Australian barley has been lifted, experts estimate Australia now has a 60% market share of the Chinese brewing/malting market and thus are estimated to supply 2.52mmt of barley for this purpose. There is general consensus amongst Australian exporters that the Chinese brewing/malting market uses ~1/3 of true Malting grade, or 756mmt, and ~2/3 of FAQ, or ~1.764mmt.

If these estimates are reasonable, it means that of the estimated 6mmt of barley exports from Australia this marketing year, China is using 3.48mmt in the feed industry and 2.52mmt in the malting industry; 756kmt shipped as Malting grade and 1.764mmt shipped as FAQ.

Of course the exact figures will be different but the estimates should be close if the broad market assumptions make sense.