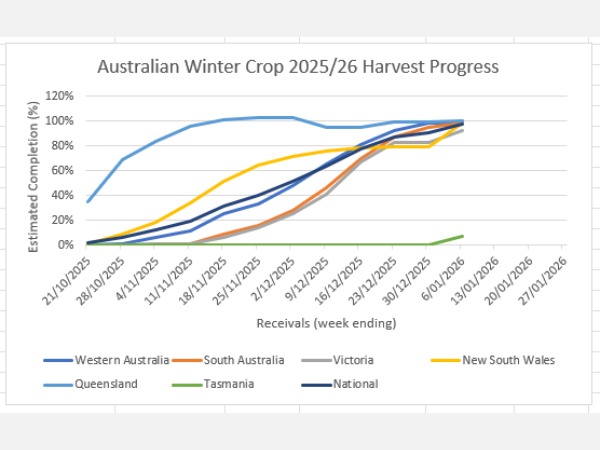

After a slow start to the Australian new crop grain export program in October 2025,…

As American tariffs reconfigure world trade and record crops and mixed demand drives grain values lower, speakers at last month’s Australian Grains Industry Conference provided clues about what the Australian grains sector might expect in the future. Following are a collection of the key points raised.

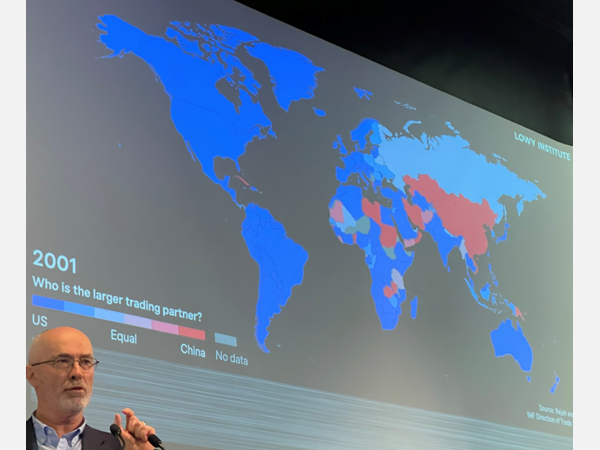

Point 1: Although the USA has been the dominant trading partner with most nations in the 20th century, there has been a radical shift in the last 20 years. Charts presented by Richard McGregor, Senior Fellow at the Lowry Institute, show China is now the dominant trading partner of most countries outside the North American hemisphere.

Point 2: An intriguing look back at wheat market conditions in WWI and WWII was provided by Dennis Voznesenski’s, author of the book War & Wheat. His message was simple: in periods of global disruption nations rapidly seek food security through a collection of subsidies and market controls which usually leads to oversupply and price reductions. Russia’s and Argentine’s deployment of export duties and China’s use of tariff rate quotas are just some of modern day examples. Could we see more of these disrupting trade in a post-American tariff world?

Point 3: China, the world’s largest importer of grains and one of Australia’s largest grain customers, is not self sufficient in grain. With this in mind, the key Chinese market drivers raised during the conference should be of note for Australian producers:

-

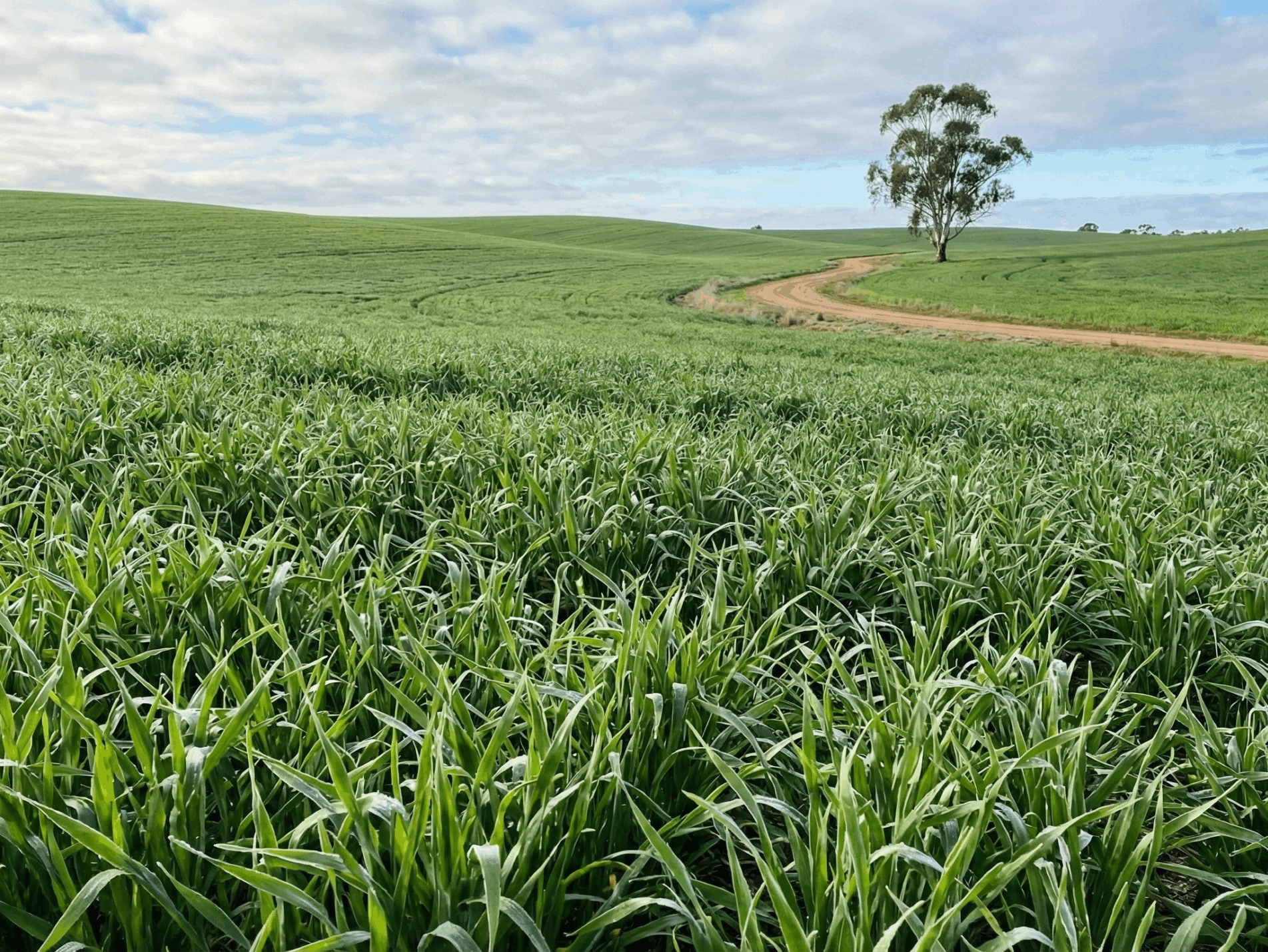

Positive drivers for Australian origin: American tariffs are moving China further towards other suppliers with Australia particularly well placed. China already prefers Australian origin – it has a counter seasonal supply base, has shorter seaborne deliveries and is price competitive under ChAFTA.

-

Negative drivers: China has heavy stocks eg 300 days of Wheat / 200 days of Corn; is producing consecutively record crops, a trend forecast to continue; is past its peak population and is aging, factors driving meat consumption and feed demand lower; and there is competition from other origins. Of course, we can’t forget the USA is not the only one who can deploy tariffs.

The American tariff story appears to be far from over but whatever way current global disruptions play out, the Chinese market is likely to become even more important for the Australia grains industry.