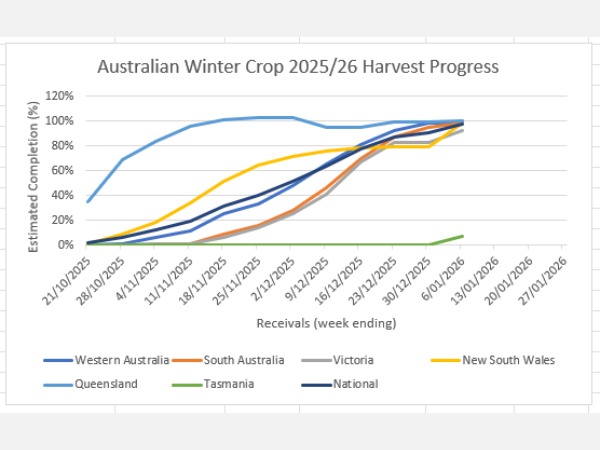

After a slow start to the Australian new crop grain export program in October 2025,…

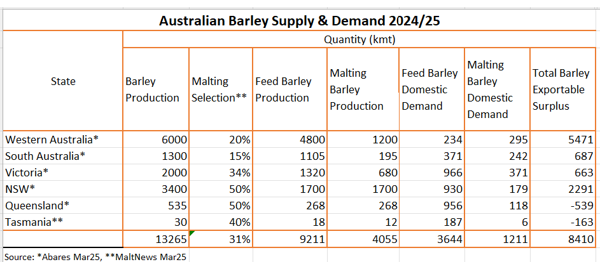

In MaltNews’ March 2025 edition, the ABARES forecast of crop 24/25 Australian barley production was provided and an estimate of the exportable surplus for feed and malt barley made.

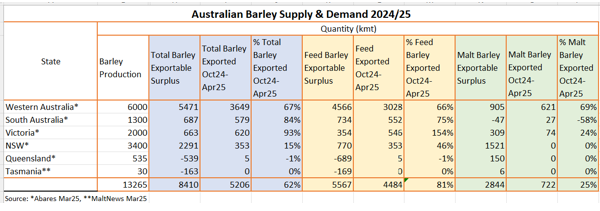

Armed with this information and using the latest ABS information for feed and malt barley exports in the period Oct24-Apr25, an estimate of the current pace of shipments headed overseas is possible.

With 5 months still to run in the normal marketing year (ending in September), the pace of exports is well on track. Whilst at first glance, this appears to be a healthy situation, trade talk has exports +85% done at June end, which is at odds with the statistics. Feed barley exports match the perception but malt barley exports are well behind.

There can be a few explanations for this: possibly malt barley exports are end loaded, carry-out stocks of malt barley could end higher or domestic use of all barley is much higher than expected.

It’s been widely reported that there has been an elevated domestic grain demand to support livestock during the East coast drought. Estimates of how much additional grain is being consumed is very difficult to make but could certainly explain the gap in export perception and the statistics.

In the next edition, we will dig deeper into this topic, as knowing how much of crop 24/25 is still available for export can be useful.