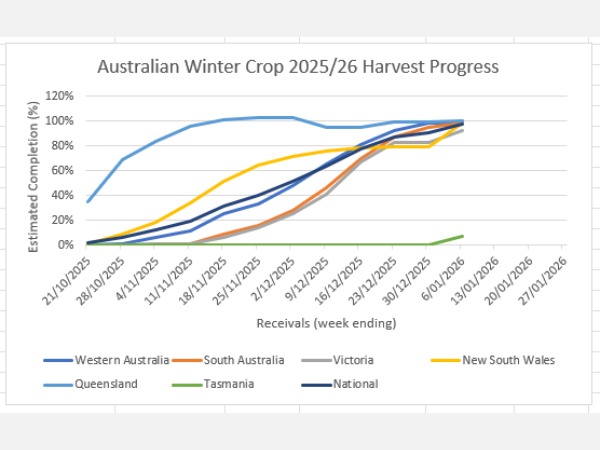

After a slow start to the Australian new crop grain export program in October 2025,…

ABARES reported Australian barley exports for the period October 22 – March 23 totaled around 4mmt: 3.6mmt of feed barley and 0.4mmt as malting barley.

Given this, that Australia produced 14.1mmt of barley in 22/23 and has a consistent domestic demand of 5mmt (feed and industrial) means we should expect another 5mmt to be exported for the last 6 months of this exporting period.

This is a sizeable but not an impossible task but does beg the question: who owns the remaining barley and where is it housed?

It is the widely held view that it’s the Grower that is long barley not the trade. For many reasons we have touched on in recent months the Grower has not been a willing seller and this is showing up when the material flows are examined. Most in the trade believe a lot of 22/23 barley remains uncommitted on farm in silos or silos bags, in local storages with some being warehoused in the bulk handling systems across the nation ready for marketing.

Growers have benefitted from 2-3 good seasons recently and with good margins on wheat and canola they haven’t had to immediately cash in on the huge barley crop. Pricing, tax considerations, the Chinese situation, how the Northern hemisphere looks and even the local mood will all determine when the Grower comes to the table to sell their barley before the pressure for storing the new crop builds from September.